About

The Forum programme includes analysis of the widest range of issues related to the further development of fintech and payment business. Opening borders, connecting West and East, uniting fintech, banks and retail, PLUS-Forum “Fintech Borderless. Eurasia Digital” invariably arouses great interest among professionals in the banking sector, payments industry, financial market and online/offline retail.

Forum participants will discuss topical topics such as:

- overcoming the consequences of the coronavirus crisis;

- further changes in priorities in the payments industry;

- Central Bank Digital Currency Projects (CBDC);

- transformation of the banking business;

- new acquiring business models;

- economics of ecosystems;

- remote identification;

- best practices in retail banking;

- interaction of banking and retail

- and many others.

Who are our participants?

- Fintech companies and startups, IT parks, IT axelerators

- Business angels, venture capital firms

- IT, telecom, and integrators

- World leading experts of banking and payment industry

- Managers of retail networks, e-commerce, wholesale companies, shopping malls

- Payment systems

- Research agencies and consulting companies

- International banking community, including participants of country markets throughout Central Asia (top management of banks, MFIs, investment funds)

- Insurance companies, management of logistic companies

- And others

Official mobile app for PLUS-Forum members

With the app you will be able to:- See the plan of the upcoming forums;

- Get the program of the forums;

- Create a personal schedule;

- Participate in the voting without a paper ballot.

The Forum Topics

Speakers 2023

Sponsors and Partners

Premium Sponsor

Official Sponsor

Platinum Sponsors

Gold Sponsors

Registration Sponsor

Bronze Sponsors

Sponsor of coffee breaks

Terms of Participation

-----

Only with the corporate e-mail address specified in the registration form

(for everyone)

- Attendance at events (conference, roundtables, exhibition) during the Forum

- Meals (coffee breaks, lunches) during the Forum

- A buffet and a cocktail party

- WiFi internet access

- Information materials of the Forum (the conference program, information of the exhibition participants, presentations key speakers, photos from the Forum)

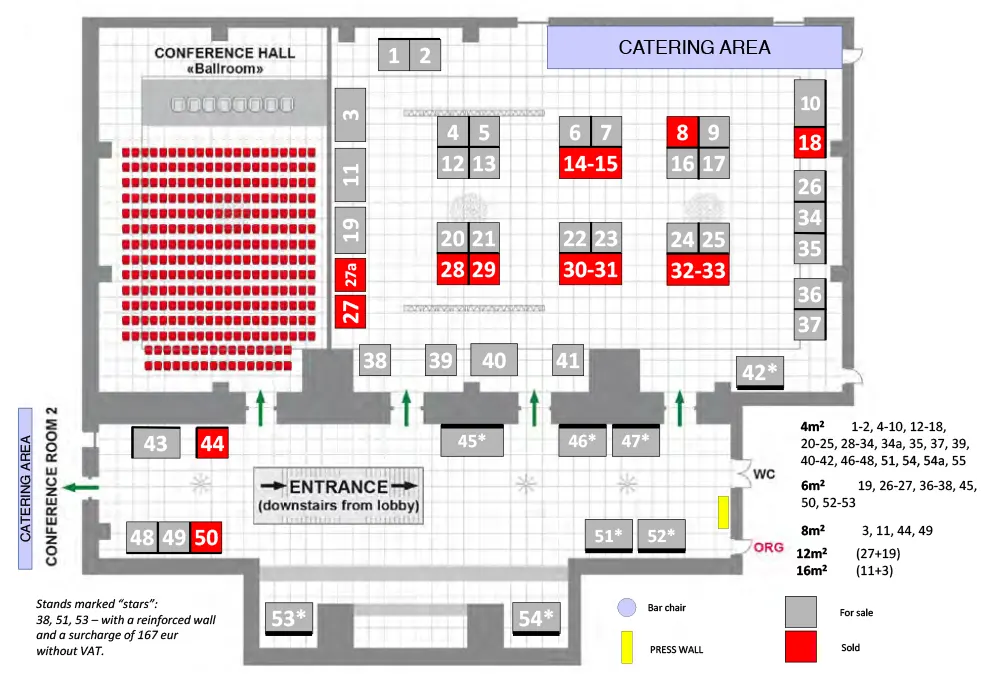

Venue Plan

Venue

RIXOS ALMATY HOTEL

Seyfullin Avenue 506/99, Almaty, Kazakhstan

Rixos Almaty Hotel — is a luxurious five-star hotel with elegant design, located on the crossroads of Kabanabay Batyr and Seyfullin streets in the heart of the green city of Almaty.

Rixos Almaty Hotel is an example of a unique combination of cozy rooms, perfect service, traditional hospitality and attention to each guest.

Preferential booking

RIXOS Almaty

* There are no standard rooms at the Rixos Hotel, the room categories are placed based on upgrades from the most budget (“Deluxe King Room”) to higher categories.

RIXOS Almaty Hotel offers special rates for accommodation of PLUS-Forum participants.

The rates are valid for accommodation from October 15 to 21.

Please send your reservation request to almaty@rixos.com or RHALA.Sales@rixos.com with the obligatory indication of the promo code PLUS in the text of the request.

List of available rooms:

- Deluxe King Room (32 m2)

- Deluxe Twin Room (32 m2)

- Superior King Room (32 m2)

- Superior Twin Room (32 m2)

- Junior Suite (48 m2)

- Superior Suite (48 m2)

- Deluxe Suite (75 m2)

- Executive Suite (110 m2)

- Presidential Suite (220 m2)